Succeeding in green building doesn’t just mean adopting new materials and technologies. Construction leaders also need to adapt their business practices, including insurance and risk management strategies, to better protect projects — and their business in general — from unique exposures.

Green building and renovation projects are known for their use of sustainable materials, such as mass timber, energy-efficient facades, and solar. Yet despite the growth in the number of these projects, the risks associated with them are less commonly known.

First, there can be challenges in sourcing materials, as many of these specialty items — including solar technology — face significant tariffs that can affect availability. There also may be delays in the procurement of other equipment, such as specialized HVAC systems, transformers, and electrical panels, which could lead to delay in start-up (DSU) coverage terms. Construction leaders need to develop new supply chain strategies to counter these issues.

Once the materials are onsite, construction firms face storage site exposures, as the high-cost materials associated with green construction are particularly vulnerable to theft and water damage. Traditional policies may not cover these kinds of losses, so additional coverage specifically for green projects may be necessary.

Finally, with severe weather disruptions growing around the globe — including 15 billion-dollar climate-related catastrophes in the U.S. in the first half of 2025 alone — insurers are more restrictive than ever in certain regions.

| Your local LeeBoy dealer |

|---|

| Brandeis Machinery |

Insurance underwriters aren’t blind to the risks of green building. They may deny or limit coverage or charge a higher premium if project owners fail to meet specific safety, documentation, and risk control requirements.

Even the most experienced firms may be unaware of the coverage gaps specifically for green building projects. Be sure to review the key coverage areas below.

Builder’s Risk, Cargo, and Stock Throughput

Traditional policies don’t have provisions for the unique complications that come with green building practices or procuring renewable building materials and technology. Secure appropriate policies to ensure you have coverage for delays or additional costs.

Contractors Professional Liability and Errors and Omissions

With so many outside consultants and contractors working together on each phase of the project, the risk of design and installation errors is higher than on traditional projects. It’s a good idea to arrange for specific endorsements, as well as CPL and E&O policies, to protect against errors made by third-party contractors.

| Your local Komatsu America Corp dealer |

|---|

| Brandeis Machinery |

Environmental Liability and Pollution

Any construction project needs contractors’ pollution liability coverage on top of a standard risk policy. But green projects, with higher-risk sustainable BESS and HVAC components, should look into special extensions to coverage.

Deductible Buybacks and Exclusions

With an increasing number of catastrophe (CAT) claims, policies may actually become more restrictive. Builders will need to review their policies and buyback options carefully to understand what is included and what has been left out.

Despite the many risks, builders that take a proactive and strategic approach toward insurance will be able to successfully navigate the challenges. Consider these four best practices.

Clearly Define Roles and Responsibilities

Green construction typically involves multiple third parties, including various design and installation specialists. With so many people involved, it can be difficult to determine liability when something goes awry. Be sure contracts and other documentation include specific information about roles and responsibilities of every party at each stage of the project.

| Your local Bobcat dealer |

|---|

| O'Leary's Contractors Equipment & Supply |

Consider All Solar Installation Risks

Solar installations, especially on rooftops, should not be done in isolation. First, the roof membrane manufacturer must provide explicit, written approval, ensuring the design of the installation won’t compromise the roof warranty. Second, building owners should consult with their insurance company to be sure the design meets all requirements and won’t negatively impact coverage.

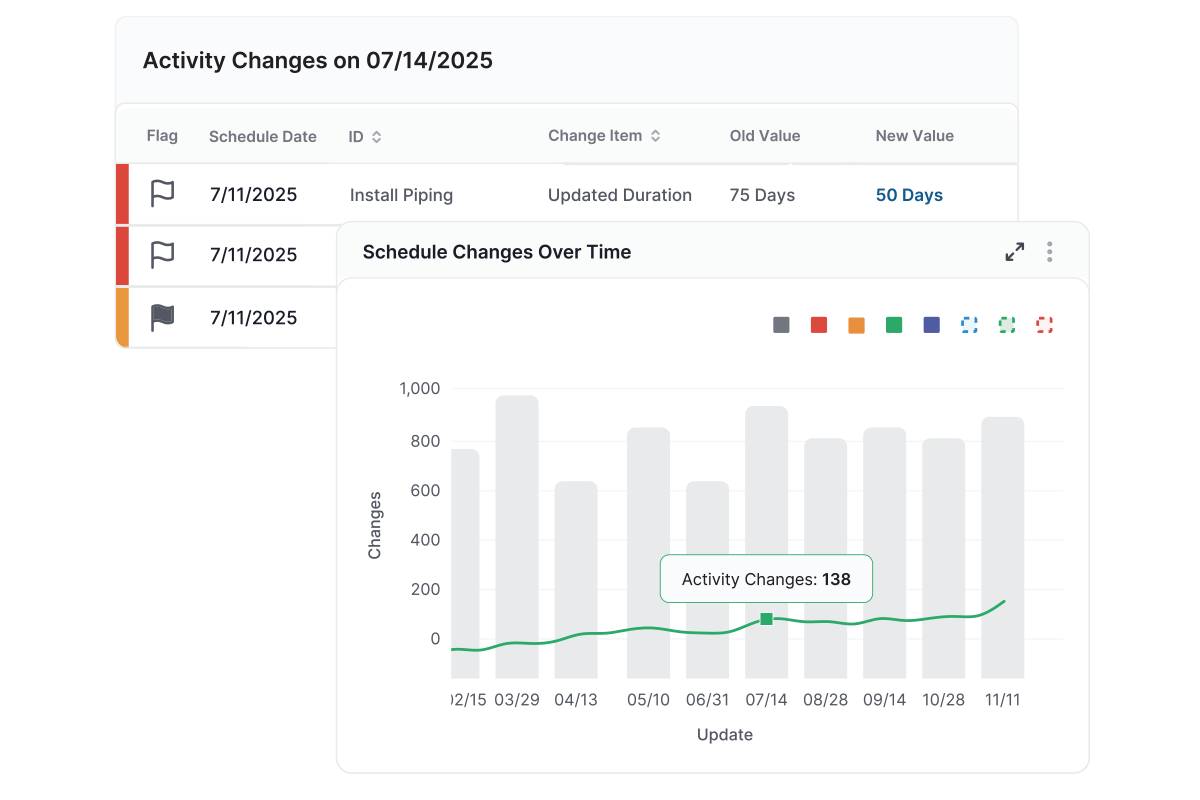

Use Technology for Protection

Consider using drones and thermal imaging to detect any issues ahead of time or support insurance claims. For example, major CAT events can damage high-cost materials like solar panels, so conducting inspections before and after a major event (i.e., wildfire, hail, or windstorm) allows the experts to identify and attribute a cause for any damage.

Talk to Expert Advisors

A broker who specializes in green construction can be an invaluable resource when it comes to avoiding coverage gaps, timeline complications, and compliance concerns. What’s more, since sustainable building continues to shift and evolve, it’s a good idea to communicate regularly with your broker to minimize any risks or other issues that crop up over time.

Kirk Chamberlain serves as an Executive Vice President for global insurance broker HUB International’s construction practice. He has more than 30 years of experience in the construction and large capital projects sector as a broker, risk manager, underwriter, and risk consultant.

| Your local Trimble Construction Division dealer |

|---|

| SITECH Midway |

| SITECH Indiana |

| SITECH Mid-South |

| SITECH Ohio |

Brandon Baucom is Vice President of Commercial Lines for HUB. He is a commercial insurance broker and risk management advisor to some of the largest contractors in the Northwest and across the U.S., specializing in complex construction risks and alternative program structures.